Real Estate Return on Investment (ROI) & How to Calculate it?

Real estate has long been a favored investment avenue, offering opportunities for both wealth creation and diversification. However, like any investment, its profitability depends on accurate evaluation, and Return on Investment (ROI) is a crucial metric for assessing real estate deals. Whether you’re purchasing a rental property or flipping homes, understanding ROI will guide you in making informed decisions. In this blog, we’ll dive into what ROI is, the factors that influence it, and how to calculate it using an ROI calculator for real estate.

What is ROI in Real Estate?

Return on Investment (ROI) in real estate measures the profitability of an investment relative to its cost. It answers the key question: “How much return am I getting for every dollar invested?” In simple terms, ROI expresses the efficiency of your real estate investment by comparing the gain or loss relative to the initial amount invested.

Key Factors Affecting ROI in Real Estate Investment

Several factors influence your real estate ROI, such as:

- Purchase Price: The lower the purchase price relative to the market, the higher the potential ROI.

- Rental Income: For rental properties, the rental yield significantly impacts ROI.

- Property Appreciation: Value increase over time can boost ROI, especially in growing markets.

- Property Expenses: Maintenance, taxes, insurance, and management fees reduce ROI.

- Financing Terms: Loan interest rates and down payment amounts influence returns.

Types of ROI in Real Estate

ROI in real estate can be assessed in various ways depending on the investment strategy:

- Cash-on-Cash ROI: Focuses on the cash income generated compared to the actual cash invested.

- Total ROI: Considers both rental income and property appreciation.

- Leveraged ROI: Takes into account the impact of borrowing (mortgages) to boost returns on smaller upfront investments.

How to Calculate ROI in Real Estate Investment

Calculating ROI in real estate can be straightforward or complex, depending on the variables involved. Here’s a basic formula:

- Net Profit: This is your revenue minus expenses (e.g., property management fees, maintenance costs, mortgage payments, etc.).

- Cost of Investment: This is the total amount spent on the property, including the purchase price and any improvements.

Example Calculation

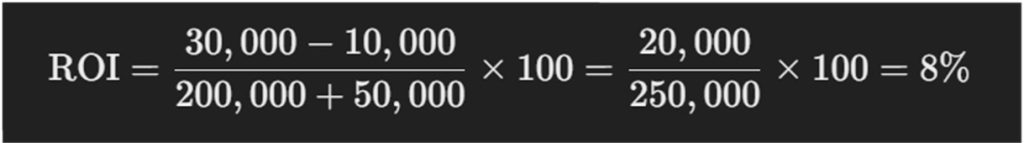

Let’s assume you bought a property for $200,000, spent $50,000 on renovations, and earned $30,000 in rental income over a year. Your total expenses for the year, including property taxes, insurance, and maintenance, amount to $10,000. Here’s the calculation:

Using a real estate investment calculator simplifies this process by accounting for complex variables like loan payments and depreciation.

Common Mistakes When Calculating ROI in Real Estate

- Ignoring Hidden Costs: Not including maintenance, vacancy periods, or closing costs skews the ROI.

- Overestimating Rental Income: Over-projecting rental income while ignoring local market conditions can lead to inaccurate ROI estimates.

- Not Accounting for Appreciation or Depreciation: Failing to include the potential increase (or decrease) in property value can lead to an incomplete ROI calculation.

Strategies to Maximize ROI in Real Estate

- Buy Low, Sell High: Acquiring properties below market value and selling them at a premium is a time-tested way to enhance ROI.

- Renovation & Value Addition: Making strategic improvements that increase property value and rental income can significantly boost ROI.

- Leverage Smartly: Using financing (leveraging) allows you to control larger assets with less upfront capital, potentially magnifying returns.

- Optimize Rental Management: Effective tenant screening, regular maintenance, and rent optimization can improve cash flow and reduce expenses.

Real Estate ROI vs. Other Investments

When comparing ROI from real estate to other investments like stocks or bonds, real estate offers distinct advantages:

- Tangible Asset: Real estate provides a physical, usable asset.

- Income and Appreciation: Real estate offers both rental income and property appreciation, while many other investments only generate capital gains.

- Leverage: Borrowing against real estate can amplify ROI, a strategy less commonly available with stocks or bonds.

ROI in Different Real Estate Investment Strategies

- Rental Properties: ROI depends heavily on rental income, operating costs, and property appreciation.

- Flipping Houses: ROI is driven by the purchase price, renovation costs, and final selling price.

- Commercial Real Estate: ROI is influenced by long-term leases, market trends, and property management efficiency.

- Real Estate Investment Trusts (REITs): These are publicly traded investments in real estate, and ROI is often reflected in dividends and stock price appreciation.

Tools and Resources for Real Estate ROI Calculation

- ROI Calculators: Tools like ROI calculators for real estate help investors quickly assess potential returns by inputting key variables.

- Real Estate Investment Calculators: These offer more comprehensive calculations, including mortgage payments, maintenance costs, and tax implications.

- Spreadsheets: Custom ROI templates allow investors to adjust inputs and model different scenarios.

- Property Management Software: These platforms often include ROI tracking features, providing real-time insights into cash flow and expenses.

Conclusion

Calculating ROI in real estate is essential to making sound investment decisions. By understanding the variables at play and using tools like a return on investment calculator, you can make data-driven decisions to maximize profitability. Real estate offers unique advantages over other investments, especially when approached strategically, making it a valuable component of a diversified investment portfolio.

Frequently Asked Questions (FAQ)

ROI is a measure of profitability in real estate investments, typically expressed as a percentage of the original investment cost. It shows how efficiently your money is working for you.

You can calculate ROI by dividing your net profit by the total cost of your investment and multiplying by 100 to get a percentage.

A good ROI in real estate in India varies by location and investment strategy, but typically a return of 8-12% is considered favorable. However, in high-growth areas, investors may aim for returns exceeding 15%.